Gambling White Paper Consultations: Land-based gambling

On 26 July 2023, the Department for Culture, Media & Sport (DMCS) published a consultation on ‘measures relating to the land-based gambling sector’ (Consultation). This Consultation directly followed on from the Gambling White Paper published in April 2023, which set out the government’s plans for modernising the regulation of gambling in Great Britain.

The White Paper included a number of measures to adjust restrictions that apply to the land-based gambling sector. The Consultation considers a range of views and evidence and looks at proposals in the following areas:

- Casino measures

- Machine allowance in arcades and bingo halls

- Cashless payments on gaming machines

- Introduction of an age limit on ‘cash-out’ slot-style category D machines

- Licensing authority fees

Concurrently with the Consultation, the DMCS published a consultation looking at a maximum stake limit for online slots games, and the Gambling Commission (GC) published their first set of consultations on the White Paper, which cover: improving consumer choice on direct marketing; strengthening age verification in premises; remote game design; and financial vulnerability and financial risk.

Casino Measures

Land-based casinos operate under two licensing regimes: the Gaming Act 1968, and the Gambling Act 2005. These regimes have different requirements in terms of the venue size and the type and volume of products casinos are able to offer. Casinos that were originally granted permission under the Gaming Act 1968 may operate under a non-remote 1968 Act casino operating licence (1968 Act Casinos). Otherwise, casinos are required to operate under a non-remote 2005 Act casino operating licence (2005 Act Casinos). Under the Gambling Act 2005, a small casino has a minimum table gaming area of 500 square metres and a minimum non-gambling area of 250 square metres (2005 Act Small Casino) and a large casino has a minimum table gaming area of 1,000 square metres and a minimum non-gambling area of 500 square metres (2005 Act Large Casino).

The Consultation is seeking views on measures which are intended to address inconsistencies between the different licensing regimes, as well as levelling the playing field (to an extent) between land-based and online operators.

The proposed casino measures under consultation are: (i) increasing gaming machine allowances for 1968 Act Casinos; (ii) changing the machine-to-table ratio for 1968 Act and 2005 Act Small Casinos; (iii) changes to size requirements for 1968 Act Casinos and 2005 Act Small Casinos; and (iv) permitting real event betting in 1968 Act Casinos.

Increasing gaming machine allowances for 1968 Act casinos

Currently, 1968 Act Casinos are permitted a maximum of 20 category B gaming machines. Gaming machines are categorised depending on the maximum stake and prize available, with category B having higher prizes than categories C and D. The proposed measures would increase this to a maximum of 80 category B machines and include a sliding scale depending on the total gambling area, the provision of a non-gambling area and the machine-to-table ratio. However, premises that still wish to offer less than 20 machines would be given the option to remain governed by the 1968 Act regime. 1968 Act Casinos that increased their gaming machine entitlement would have to match the operating and premises licence fees charged for 2005 Act Casinos.

Changing the machine-to-table ratio for 1968 Act Casinos and 2005 Act Small Casinos

Currently there is no machine-to-table ratio for 1968 Act Casinos, small casinos apply a machine-to-table ratio of 2:1 (e.g., 2 machines to 1 table) and large casinos benefit from a ratio of 5:1. The Consultation proposes to offer a single ratio to all casinos of 5 machines to every 1 gaming table (except for 1968 Act Casinos with gaming areas smaller than 280sqm or those choosing to remain with the old regime).

Changing size requirements for 1968 Act and 2005 Act Small Casinos

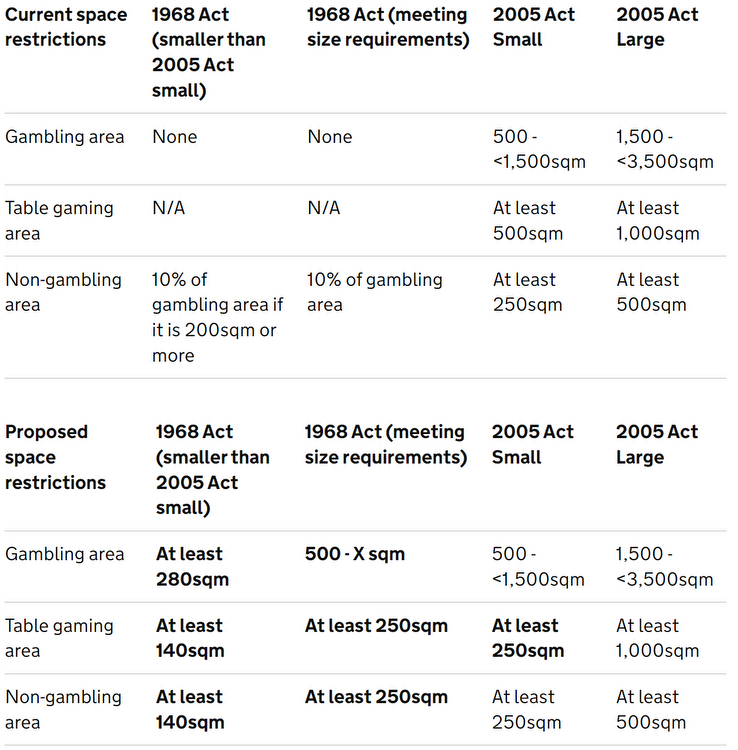

The Consultation also suggests measures to make size requirements more consistent across the two licence regimes. The proposed changes are set out in the table below:

There are three options suggested for the value of ‘X’ shown in the table above: (a) <1500sqm, (b) <1500sqm with a conditional exemption for 1968 Act Casinos which are larger, and (c) no maximum. The Consultation is also clear that alternative proposals will be considered.

Permitting real event betting in 1968 Act casinos

Currently, betting is permitted in 2005 Act Casinos but not in 1968 Act Casinos. Casinos would be permitted up to 40 self-service betting terminals, reducing on a sliding scale to 16, depending on their total gambling area. If casinos wish to offer betting services, a non-remote betting operating licence would be required plus a remote betting operating licence for self-service betting terminals.

The key benefit identified in relation to these casino measures is the increase in the gross gambling yield (GGY), with only transitional costs to the operators. The Consultation also makes specific references to increasing the appeal to international tourists and Britain’s reputation as a gaming destination.

Machine allowance in arcades and bingo halls

Arcades and bingo premises are licensed to provide category D, C, B3 and B4 gaming machines. Licences granted before 13 July 2011 have a slight variation to the standard 80:20 rule, known as legacy rights, otherwise 80% of all gaming machines within arcades and bingo premises must be category C or D gaming machines. However, the government acknowledge that this does not allow operators to satisfy consumer demand. Considering demand, new player safety controls, the energy cost of maintaining unused category C and D machines, and the declining relative value of stakes, the government have proposed to amend the 80/20 rule and replace it with a 50/50 machine ratio between category B and category C and/or D machines. The Consultation put forward three options:

- “Introduce the 50/50 rule while maintaining current requirements for ‘available for use’.

- Introduce the 50/50 rule with an additional requirement that any gaming machine device types offered in individual premises (whether cabinets, tablets (fixed or hand-held) or in-fill) comprise a minimum of 50 percent category C and D machines. Also, category C and D gaming machine device types made available for use must be of similar size and scale to category B.

- Remove the 80/20 rule completely, applying no requirements on set gaming machine ratios.”

The Consultation highlights the benefits to GGY, the potential energy saving, and that player protections that can be used to mitigate increases in the risk of gambling harm. The GC will also conduct a review of the gaming machine technical standards in due course. This will include assessing the role of sessions limits across category B and C machines alongside safer gambling tools.

Cashless payments on gaming machines

The Gaming Machine (Circumstances of Use) Regulations 2007 prohibit the use of debit cards for direct payments to gaming machines and prohibit any use of credit cards (including indirect means, a TITO (ticket-in, ticket-out) method or an operator-provided app-based digital wallet). This also applies to contactless mobile systems such as Google Pay or Apple Pay on gaming machines. The government is keen to “future-proof” gaming machine payment methods, however, it acknowledges the need to balance this with any elevated risk of harm. There is no intention to lift the prohibition on credit card payments, but the Consultation proposes the introduction of direct forms of cashless payments on gaming machines, subject to suitable safeguards.

The potential safer gambling measures include requiring account holder authorisation/verification for direct cashless payments and displaying session time and net position on machines that accept direct cashless payments. The Consultation, again, refers to the GC’s future review of the gaming machine technical standards to assess safer gambling tools. The Consultation also suggests that the definition of ‘cashless payment’ should be flexible enough to accommodate for future technological change within payment methods.

Introduction of an age limit on ‘cash-out’ slot-style category D machines

Category D gaming machines (such as such crane grabbers, coin pushes and cash out slot style machines) can be played by under 18s. However, as set out in the White Paper, there are concerns that ‘cash-out’ slot-style machines share similarities with higher stake machines which are restricted to adults. Members of the Bacta trade association took voluntary action to ban under-18s from playing ‘cash-out’ slot-style machines in 2021, and the Consultation looks to make this voluntary approach mandatory. If enshrined in law, it would be an offence for a person to invite, cause, or permit a child or young person to use ‘cash-out’ category D slot-style games. The government’s proposal does not require that these machines be moved to an age-restricted area and as such, they can remain where they are positioned. However, premises will need to be careful to ensure that young people are not permitted to use these machines. The Consultation also states that the government does not currently support a ban on children accessing other category D machines due to the lack of substantive research or evidence clearly identifying harm to children resulting from the use of these machines.

Licensing authority fees

Finally, the DCMS is proposing to increase the maximum limit for licensing authority fees, noting that (despite inflation) it has not been updated since 2007. The increase would allow local authorities to cover the costs of enforcement and administration of their gambling duties. The Consultation notes that the government do not have sufficient evidence to determine the level of increase and so have proposed three options:

- “10% increase in all maximum fees. This would potentially generate an additional £780,000 in total annual funding for local authorities and increase average annual costs per premises by £84.

- 20% increase in all maximum fees. This would potentially generate an additional £1,560,000 in total annual funding for local authorities and increase average annual costs per premises by £167.

- 30% increase in all maximum fees. This would potentially generate an additional £2,340,000 in total annual funding for local authorities and increase average annual costs per premises by £251.”

The proposed increase would not provide local authorities with an automatic right to increase their fees. Authorities must be able to demonstrate the increase is necessary to undertake their enforcement and compliance duties.

GamCare Response

On 16 October 2023, GamCare, the charity that raises awareness on gambling related harms in the UK, published its response to the Consultation. In their response, GamCare noted their concern that the proposal to allow more electronic gaming machines with higher stakes across premises could increase gambling-related harms and that there is a lack of local government power to manage gambling premises, and the new proposals could potentially worsen the situation. GamCare support the age-limit on cash-out category D slot machines but want to see stronger player protections in land-based gambling premises, including setting monetary and time limits on machines, deposit limits and automated breaks in play to interrupt the rapid and continuous pace of play. The response also suggested that card account verification should be required for every transaction, and a maximum deposit limit should be set to avoid unintended spending consequences for individuals.

Next Steps

The Consultation was open for 10 weeks, closing at 11:55pm on 4 October 2023. Following the closure of the Consultation, the government will now publish a formal response to set out their decision and reasoning before implementing the changes.

Co-authored by James Leek, Trainee Solicitor at CMS.