Can casinos in Henderson, southeast Las Vegas revive?

While the Strip gets attention from customers and investors for its frequent revenue growth, gaming industry watchers may look to the Las Vegas Valley’s east side for an idea of how a typical locals casino customer is spending — and what that suggests for the area’s future gaming growth.

The Boulder Highway subregion of the Las Vegas locals market is seeing tougher year-to-year comparisons in gross gaming revenue, a trend Wall Street analysts and industry watchers attribute to weaker visitation and spending for lower-end customers. Gross gaming revenue for the 30 non-restricted casinos making up the submarket is down about 1 percent so far this year from the same period last year, according to statistics from the Nevada Gaming Control Board.

While some are watching the region — generally covering southeast Las Vegas and Henderson — for signs of inflation’s longer-term effects on customers, others are looking ahead to development projects that could challenge the status quo.

Revenue trends flat for subregion

Analysts have been monitoring the regional gaming market since coming out of the COVID-19 pandemic, when the industry benefited from stimulus checks. But as inflation ramped up in 2022 on, observers have been keen to see how much of that growth could stick around long-term.

Chad Beynon, a senior analyst at Macquarie Capital, said 2023 trends were similar to, if slightly lagging behind, the locals market performance across the valley — the Boulder Strip’s gross gaming revenue was flat from a year earlier and up 12 percent from 2019, while the Las Vegas locals market was up 2 percent from a year earlier and up 22 percent from 2019.

But year-to-date trends suggest new competition at Durango resort-casino, a Station Casinos property that opened in the southwest valley in December, has affected the other side of the valley. While the Boulder Strip’s gross gaming revenue is down 1 percent, the locals market at large is up 6 percent.

Other publicly traded gaming companies have noted the trend as well. During a first-quarter earnings call for Las Vegas-based Golden Entertainment, operators of the Strat and Arizona Charlie’s and PT’s brands, executives said revenue for its locals casino segment declined 5 percent because of “decreased visitation spend in (its) low- and mid-tier rated players.” It noted the largest declines were at Arizona Charlie’s Boulder, the company’s “most value-oriented casino.”

Meanwhile, Las Vegas-based Boyd Gaming has kept one of its Boulder Highway-area casinos, Eastside Cannery, shuttered since pandemic-related shutdowns forced its closure in March 2020. Executives for the company have said they are keeping it closed until demand returns. In the meantime, customers have been diverted to nearby Sam’s Town.

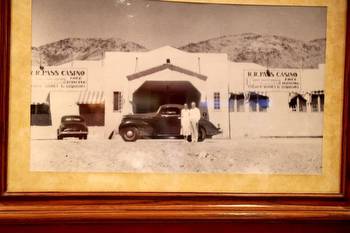

Joe DeSimone, owner of The Pass in Henderson’s Water Street District and Railroad Pass near Boulder City, said his customers’ spending patterns are changing but not in a way that causes alarm. He responded by looking for efficiencies on the casino floor, such as removing the loss leading table game pits at both properties.

“Instead of coming three nights a week, they might come two nights a week,” DeSimone said. “We understand that. What we’re trying to do is create an environment where people bet a little bit more to accommodate our additional costs.”

Future development

DeSimone has his sights set on upscaling. His company, First Federal Realty DeSimone, is developing Atwell Suites at The Pass. The project is targeted to open in October and will include 90 rooms, operated by IHG Hotels and Resorts, and a street-level wine bar.

He said the goal is for the hotel to reach beyond Henderson locals and visitors for hockey tournaments at the neighboring America First Center ice rink. With Fiesta Henderson’s closure and demolition in 2022, there are fewer hotel competitors east of Interstate 11.

“Our theory has always been to bring people to Water Street that hadn’t come there before and add to the pie there,” DeSimone said. “It’s not just there to accommodate the tournaments at the hockey rink, it’s there to complement the whole city.”

Future developments could affect the region, too. Red Rock Resorts, the parent company behind Station Casinos, has plans to develop a resort with 201 rooms and 58,000 square feet of casino in Henderson’s Inspirada community, several miles south of the Boulder Strip. No construction timeline has been announced on that project.

Still, Beynon said the region’s demographic trends for the locals market are a benefit to most operators. Boulder Highway, with about 90 percent of its gaming revenue derived from slots, could benefit from Southern Nevada’s expected population changes.

“But (it’s) worth noting that demographic trends for the Locals market are positive — high population growth particularly in the older age group with growing household income and a solid labor market,” he said in an email.