BGC Holds Inaugural Gambling Anti-money Laundering Group (GAMLG) Training Day

UK gambling standards body Betting and Gaming Council (BGC) delivered the inaugural Gambling Anti-Money Laundering Group (GAMLG) Training Day on April 25.

GAMLG was established in 2016 by the Association of British Bookmakers (ABB) and Remote Gambling Association (RGA). It is now supported by the Betting and Gaming Council who provide the secretarial function and has been independently chaired by Keith Bristow QPM, who was previously the first Director General of the National Crime Agency, since its inception.

The objective of the Group is to reduce money laundering risks within the sector and to promulgate best practice amongst operators. While gambling is rated as low risk in the Government’s National Risk Assessment, the industry is determined to drive up standards and encourage best practice across its membership to keep crime out of gambling.

The focus of the day was to share best practice and discuss topical issues for the gambling sector in the Anti-Money Laundering and Counter-Terrorist Financing space. The event was attended by over 80 members from across over 30 different organisations, including Entain, William Hill, Betway, Playtech, Gamesys and Genting. The aim of the day was to encourage operators of all sizes to consider key emerging risks, best practice and developments, reflecting the diversity of compliance functions across BGC operators.

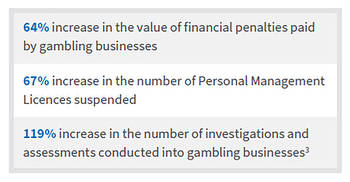

Members heard from Senior Manager, Claire Wilson, from the Gambling Commission on the current regulatory landscape and lessons from enforcement cases. Director General of the National Crime Agency, Graeme Biggar, also spoke to the group about the current threat landscape as it pertains to gambling and anti-money laundering. Additional sessions took place on SARs best practice, delivered by the UK Financial Intelligence Unit, as well as a tutorial from KPMG on building a culture of compliance.