A Moment of Truth for UK Online Gambling Operators

This is the first overhaul of the governing rules and regulatory approach to the complex UK gambling industry since 2005. The UK Gambling Commission (“UKGC”) called it a “once-in-a-generation opportunity” to deliver positive change.

UK-licensed online gambling operators are arguably the most affected group by the imminent implementation of the review measures, most of which are targeted to come into force by summer 2024. To be ready they must urgently reshape their safer gambling (“SG”) and anti-money laundering (“AML”) processes, people, and technologies.

Will Adaption Be Costly?

Leading gambling conglomerates have already encountered financial setbacks due to the pre-emptive implementation of stricter AML and SG controls. They have sometimes adopted a blanket approach to implementation, including the offboarding of high-spending or VIP customers. Yet, in spite of self-imposed restrictions, operators continue to face the stringent supervision and enforcement activity that the UKGC put in place in 2017. This has shaken investor confidence and UK-derived revenues have fallen with operator’s senior management being held to account.

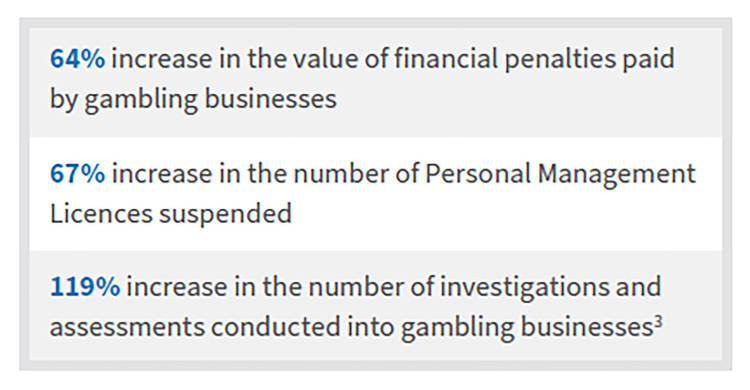

Escalating Enforcement in the UK Gambling Landscape

Last month saw the UKGC open the first tranche of consultations in the implementation of the proposed measures, including the hotly debated prescriptive financial risk checks. Faced with uncertainty, gambling operators need to act now or risk greater hits to their bottom line that could be a moment of truth. Initial estimates of the collective impact on remote operators range between an 8% and a 14% reduction of gross gambling yield (“GGY”) — which indicates lower revenue and potentially reduced profitability, leading to financial challenges, potential regulatory implications and difficulty in maintaining market competitiveness.

Can Operators Stay Ahead of the Regulatory Curve?

At FTI Consulting, our Financial Crime Compliance team leverages our cross-industry, multi-jurisdictional expertise and experience to be trusted advisors for operators of all sizes. We help them to best prepare AML and SG frameworks ahead of regulatory reform. As proposed changes take shape, we can also help operators lessen the implementation burden by applying lessons learnt and best practices from the financial service sector.

Below we discuss strategic shifts to processes, people and technology to guide the transformation required to weather an already stagnating market clouded by regulatory uncertainty.

Shift #1: Restructure siloed teams to streamline Know Your Customer (“KYC”) processing

Dedicated AML and SG teams should operate independently from the business, but not siloed from one another, other risk management teams or across sub-brands of operators. For example, duplicating due diligence checks across AML and SG teams creates several risks, potentially missing red flags picked up by another team, inconsistencies in implementation of controls and diluted staff accountability over management of key risks. Many customers who fail to get through KYC checks on their first attempt, whether at the account opening stage or upon reaching designated thresholds set by operators, will not return and move on to the competition. In order to simplify operations, bolster defences, while reducing friction for legitimate customers, many AML controls overlap with and can be leveraged to satisfy SG obligations, such as:

- customer risk assessment,

- collecting proof of source of funds and source of wealth,

- transaction monitoring,

- escalating of suspicions.

The intertwined nature of AML and problem gambling risks means that operators need to redesign and implement target operating models that maximise information sharing, including defined RACI matrices, organisation structures and formalised collaboration forums. This promotes a more holistic overview of risks. If operators restructure their siloed teams to streamline their KYC processing, they will deliver improved customer experience, realise operational synergies and uncover cost savings.

Shift #2: Integrate technology platforms to enable a single customer view across brands

UKGC enforcement outcomes highlight the lack of central oversight by parent entities over customer activity across sub-brands and group subsidiaries. Without a complete view of customer activity, thresholds and limits set for monitoring and prevention of harm purposes will not be effective. This was most recently demonstrated by the £19.2 million financial penalty imposed on three gambling businesses owned by William Hill Group — the largest to date. To future-proof their businesses, operators should prepare for the introduction of prescribed financial risk checks and data sharing through the potential cross-operator harm prevention system mentioned in the policy paper. Operators need to centralise their IT infrastructure and refine identification parameters linking multiple customer accounts across sub-brands. In doing do they will prevent one bad apple from spoiling the bunch.

Shift #3: Quickly integrate the KYC processes of new acquisitions with a thorough risk assessment

It is best practice for AML and counter-terrorist financing (“CTF”) standards, policies, and procedures to be aligned organisation-wide. Applying different KYC standards when not justified by the different nature of products can led firms to underestimating the risks within their client portfolio and expose the firm to potential regulatory scrutiny. With strong M&A-fuelled growth, it is important to design a unified set of KYC standards with top-ups on an as-needed basis to facilitate more consistent and comprehensive monitoring. An understanding, of AML and SG risks across brands is therefore essential. A critical lever to get right is a consistent customer risk-rating methodology which will guide the application of robust KYC processes, particularly enhanced due diligence. Notable AML breaches and fines have been dealt out to financial service firms because senior management often inherit and become reliant on ready-made compliance frameworks, controls and processes of targets which may not necessarily be fit-for-purpose.

All in all, federated AML and problem gambling risk management practices across sub-brands create operational inefficiencies and an uneven customer experience, leading to red flags being missed. Fines do not have to be the cost of doing business. Being proactive and measured in remedying the pain points described above will separate the wheat from the chaff and create a competitive advantage in an industry where the regulators are more aggressively flexing their muscles.

Having worked with and on behalf of different gambling regulators globally, we have a clear view of good and best practices in respect of AML and social responsibility frameworks and know what works for different types and sizes of operators. We have a proven track record of helping some of the world’s largest remote and non-remote casino, gaming, and betting operators with:

- AML and SG framework review and design

- AML/CTF and SG risk assessments

- Unified policy and standards definition for multi-jurisdictional operations

- AML and SG capability assessment and training

- Crisis and strategic communications

- Regulator intermediation and inspection support

- Vendor selection and system assurance

- Attestation support and assurance of financial crime and SG controls

FTI Consulting understand the need to navigate disruptive forces and strengthen AML and SG frameworks and business practices in a way that makes commercial sense. If your organisation needs guidance on any of the above areas, please speak to one of the experts in our FTI Consulting’s Financial Crime Gaming Centre of Excellence, who are supported by a range of data analytics and strategic communications specialists.

Footnotes:

3: Figures calculated from the Gambling Commission’s annual enforcement reports (2018-2019, 2019-2020 and 2020-2021), which provide an overview of the enforcement work undertaken over the past year and the lessons that operators should learn from that work. Note these figures include enforcement action against both land-based and online operators.

4: UK Department for Culture, Media & Sport, “High Stakes: Gambling Reform for the Digital Age” (policy paper), published 27 April 2023. FTI Consulting notes that these initial estimates are subject to changes following development of policy details through forthcoming consultations. “GGY” refers to the amount retained by gambling operators after payment of winnings but before deduction of costs of the operations. https://www.gov.uk/government/publications/high-stakes-gambling-reform-for-the-digital-age/high-stakes-gambling-reform-for-the-digital-age#executive-summary