The average revenue per user in the Online Gambling market is projected to amount to US$296.50 for 2024

The online gaming market in North America is big business; there is no denying that, and, by all accounts, it will get bigger. The average revenue generated annually per customer is predicted to hit almost US$300. That means that, as a whole, industry revenue is projected at US$29.9 billion. There is no doubt that someone seems to have won the jackpot, and, by all accounts, it is the iGaming industry.

A progressive societal view of gambling, together with technological changes and relaxation of laws and updated regulation, means that a pastime that was once largely confined to Las Vegas, Atlantic City, Louisiana riverboats and underground poker dens is now a relatively mainstream activity across the country. Of course, there are exceptions with states like Utah and Hawaii, but gambling, in some form or another, is now legal in almost all of the USA.

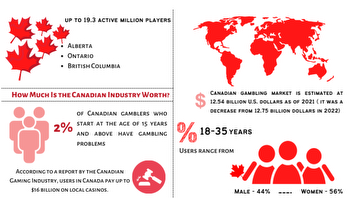

In Canada, Ontario (the most populous province) has a fully regulated online commercial market allowing all forms of gambling. It opened just over two years ago, and revenue for the second year was up by over 70% on the first. iGaming Ontario reported that over 80% of gamblers were now playing on official, regulated sites rather than at risky offshore casinos. As Canadians love to gamble – over six in ten profess to have spent money on gambling, and there are 19.3 million active online gamblers, it is highly likely that other provinces will follow in Ontario’s footsteps. Alberta has just set aside CAN$1 million for a gambling review. The minister in charge of that review is mandated to work with Indigenous partners to scope, develop and implement an online gaming strategy. That sounds rather like a ringing endorsement rather than a tentative review.

What we are seeing in 2024 is only the tip of the iceberg. Five-year forecasts predict that online gambling will show an annual growth rate of 8.4%, resulting in a projected market volume of US$44.82 billion by 2029. There is no denying that the market is experiencing enormous growth and development. Much of the growth is fuelled by the excitement and thrill of playing online slots; these are by far the most significant section of the online casino market. Customers are increasingly playing online gambling sites, whether at your desk or on your mobile, as they are accessible, convenient and fun. There is such a huge array of titles that everyone who likes to play the slots can find a title that fits right in with their personal choices. The ability for people to play from the comfort of their own homes, whenever they choose to, is a massive draw.

Even in areas where real-money wagering is not allowed, there is a growing availability of social casinos. These ‘just for fun’ platforms have a great selection of games. However, rather than wagering directly for money, players wager with ‘gold coins’ and are rewarded with more gold coins. The thrill is about the ‘win’ and progression rather than financial gain. However, it is also possible to wager with the coins won and convert the wins into cash prizes. So indirectly, it is possible to win real-money prizes at social casinos, but most people play for the buzz.

In addition, one of the takeaway trends of the North American online gambling market is the popularity of mobile gaming. Now that so many people have smartphones and tablets, players are increasingly choosing to take their online casino out and about with them. They are opting to play from a mobile device rather than on their desktop computer. This has led to a hyper-casual relationship with online casinos and the developers adapting with tailored apps and mobile-friendly gambling platforms. It is not just the games that are adapted either; payment options are also tailored to be mobile-friendly making the whole business of fun simple and integrated.

Real money gambling is increasingly socially acceptable, and legislation is changing all across North America. More jurisdictions are recognizing the benefits of legalizing online gaming. Not only do taxes bring in much-needed money to state and provincial coffers, but licensing sites ensures operators adhere to strict rules to minimize potential gambling harms. These include strict age checks to deter underage gambling, stake limits and opt-outs, amongst other safe gambling tools. There is increased competition amongst online operators to create fun and compliant sites to obtain licenses and market share in the newly opened markets.

In the United States, another significant driver has been the legalization of sports betting. In 2018, the Supreme Court struck down a federal ban on sports betting, ruling that it was unconstitutional. Several states saw the opportunity and moved rapidly to legalize and regulate the industry. There is now a lucrative market for online sports betting companies, and more states are introducing legislation to maximize the opportunities. Mobile sports wagering has been legal in New York for two years, and the state has collected more than USD$1.55 billion in taxes on those bets. Most of that has been spent on education.

On announcing the most recent figures, New York Governor Kathy Hochul said,

“Over the last two years, New York is the clear leader in providing responsible entertainment for millions while bringing in record-shattering revenue for education, youth sports, and problem gambling prevention. I look forward to this third year of our successful gaming policies that deliver top-tier mobile sports wagering experiences. We will continue to generate revenue that will enrich the lives of New Yorkers, all with important safeguards in place to help those who need it.”

The revenue breaks down to USD$862 million last year, together with USD$693 million in the first year and $200 million in licensing fees. More than 5.6 million unique sports betting accounts have been created, and over 2.6 billion wagers have been placed in New York alone.

In Canada, the federal government has historically taken a hands-off approach to enforcement, allowing offshore operators to cater to Canadian players. However, provinces like Ontario and Alberta have realized they are missing out on valuable revenues, and the situation in the country is also being shaken up. Quebec might be the next province to implement changes. While it officially offers a centralized ‘monopoly’ online gaming platform, Espace Jeux, it turns out 72% of users only go there to buy lottery tickets and play online casino games at privately operated sites that do not pay any revenues to the province.

The authorities are recognizing that the North American region has a high level of internet penetration and a strong gambling culture. Rather than fight against the inevitable, many are working with the industry to ensure the best possible experience. It is what you could describe as a win-win situation.