Sports Wagering Revenue Down, Casino Revenue Ticks Up

Sports wagering contributes $2.8 Million in tax revenue during June.

Maryland’s ten retail and ten mobile sportsbooks generated $2,835,051 in contributions to the State. Each sportsbook contributes 15 percent of its taxable win to the Blueprint for Maryland’s Future Fund, which supports public education programs.

June is typically a slower month, with fewer events on the sports wagering calendar. As such, the statewide handle in June totaled $254,476,790, down 20.5 percent from May.

Maryland Lottery and Gaming is now providing monthly sport-specific handle figures. In June, baseball wagers represented 25 percent of all wagering at $65.2 million.

Parlay bets of two or more combined wagers accounted for $93.3 million, or nearly 37 percent of all bets. The combination wagers were the most profitable for sportsbooks during the month. Operators posted a 20% hold on parlay bets.

Here are the statewide sports wagering totals for June 2023:

Handle (Amount players wagered, including free promotional wagers)

- Retail: $10,659,617 (includes $3,895 in free promotional wagers)

- Mobile: $243,817,173 (includes $7,754,571 in free promotional wagers)

- Combined: $254,476,790

Prizes (Winnings paid to players)

- Retail: $10,025,716

- Mobile: $217,373,956

- Combined: $227,399,672

Hold (Handle, less prizes paid)

- Retail: $633,901 (5.9%)

- Mobile: $26,443,217 (10.8%)

- Combined: $27,077,118 (10.6%)

Taxable Win (Amount remaining after deducting prizes, promotional wagers, and other amounts)

- Retail: $608,277

- Mobile: $18,292,060

- Combined: $18,900,337

Sports Wagering Tax (15 percent of the Taxable Win)

- Retail: $91,242

- Mobile: $2,743,809

- Combined: $2,835,051

Since the inception of Maryland’s sports wagering program in December 2021:

- Cumulative contribution to the Blueprint for Maryland’s Future Fund: $28,141,705

- Cumulative expired prizes contributed to the Problem Gambling Fund: $2,224,168

In 2020, Maryland voters approved a constitutional amendment to expand commercial gaming by authorizing sports and events wagering to raise revenue for education. A detailed summary of each sportsbook, including handle, hold percentage, prizes paid, promotional play, taxable win, and contribution to the state, is available for download from the link above. Prior months’ reports are available at mdgaming.com.

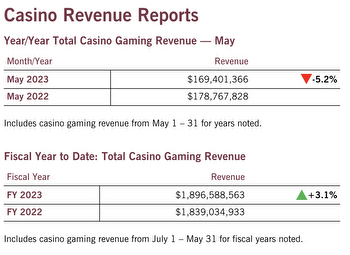

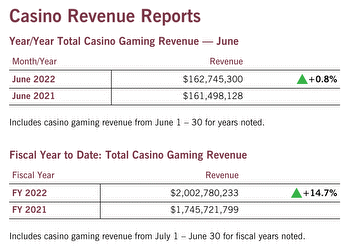

Last month, the state’s six casinos generated $163.7 million in gaming revenue, contributing $69.4 million to the State of Maryland.

According to Maryland Lottery and Gaming, the total represents an increase of $971,931 (0.6 percent) compared to June 2022. Contributions to the Education Trust Fund (ETF) in June 2023 were $50,433,185, an increase of $764,425 (1.5 percent) compared to June 2022.

Casino gaming revenues also support the communities and jurisdictions where the casinos are located, Maryland’s horse racing industry, and small, minority- and women-owned businesses.

Maryland’s six privately owned casinos offer slot machines and table games: MGM National Harbor in Prince George’s County, Live! Casino & Hotel in Anne Arundel County, Horseshoe Casino Baltimore in Baltimore City, Ocean Downs Casino in Worcester County, Hollywood Casino Perryville in Cecil County, and Rocky Gap Casino Resort in Allegany County.

In 2018, Maryland voters approved an amendment to the State Constitution to safeguard State video lottery terminal revenues for education.

As described in the bill and the ballot question, supplemental funding must total at least $125 million in fiscal 2020, $250 million in fiscal 2021, and $375 million in fiscal 2022. One hundred percent of the gaming revenues dedicated to public education must be supplemental funding in subsequent years.

The gaming revenue totals for June 2023 are as follows:

MGM National Harbor (2,290 slot machines, 210 table games)

$69,043,101 in June 2023, an increase of $632,428 (0.9%) from June 2022Live! Casino & Hotel (3,845 slot machines, 179 table games)

$57,979,627 in June 2023, an increase of $1,979,637 (3.5%) from June 2022Horseshoe Casino (1,430 slot machines, 122 table games)

$15,941,209 in June 2023, a decrease of $1,110,637 (-6.5%) from June 2022Ocean Downs Casino (858 slot machines, 19 table games)

$8,679,006 in June 2023, an increase of $125,524 (1.5%) from June 2022Hollywood Casino (690 slot machines, 19 table games)

$6,954,407 in June 2023, a decrease of $433,399 (-5.9%) from June 2022Rocky Gap Casino (620 slot machines, 16 table games)

$5,119,881 in June 2023, a decrease of $221,622 (-4.1%) from June 2022

As previously reported on Conduit Street, Maryland Lottery and Gaming is assessing online casino expansion. Online casinos enable bettors to play and wager on casino games via the internet. While many states allow brick-and-mortar casinos and sports wagering, only six states allow online casinos: Connecticut, Delaware, Michigan, New Jersey, Pennsylvania, and West Virginia.

While the Comptroller’s Office estimates that online casino gaming could generate nearly $100 million annually for the Education Trust Fund, MACo anticipates that online gaming will impact revenues associated with in-person table games and slots. As such, in addition to advocating for an equitable share of new gaming revenue, counties will seek to protect existing revenue streams on which local governments have relied for several years and which support essential services and infrastructure for our communities.