Illegal online gambling may rise in India due to high taxes, study says

A study by the Centre for Knowledge Sovereignty predicts a 30 per cent rise in illegal online gambling.

India.- The Centre for Knowledge Sovereignty (CKS), a policy think tank based in Delhi, has released a study that suggests high taxes and insufficient legal frameworks are driving people towards illegal online gambling. The study estimates that the illegal betting market in India handles deposits amounting to US$100bn annually and may grow by 30 per cent this year.

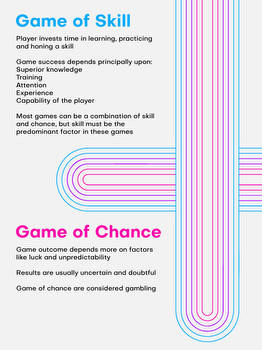

The study cites independent statistics showing a 7 per cent compound annual growth rate (CAGR) from 2012 to 2018. Vinit Goenka, founder secretary of CKS, said the current legal framework for online gaming is inadequate and that illegal operators are taking advantage of the new tax regime, which imposes a 28 per cent tax on deposits for legitimate gaming platforms.

Online gaming companies registered under the new GST regime contributed INR3,500 crore in the October-December quarter. The central government expects to collect up to INR14,000 crore in GST from the sector in the next financial year and INR80,000 crore over the next five years.

Goenka said efforts by the Ministry of Technology to ban offshore betting websites had failed as illegal operators continue to re-emerge under new web domains. He said state-level bans on legitimate skill-based gaming aggravated the problem. For instance, Telangana’s ban on all online games in 2017 led to an increase in illegal online gambling.

CKS has suggested that the government should establish a dedicated task force to address illegal operators, both offshore and domestic. They also recommended creating a “Whitelist” of companies offering skill-based games, ensuring that payment gateways, hosting providers, and internet service providers only service these operators.