IAMAI Urges GST Council To Keep 18% Tax On Online Gaming

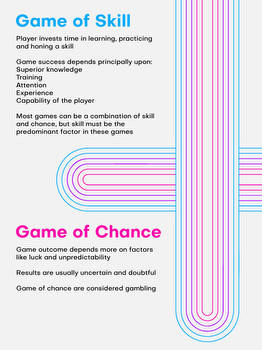

There is no clarity on whether this will apply only to real money games or casual games as well, given that the former being a sub-segment of online gaming.

Discussions are ongoing among various stakeholders to increase the GST rate to 28 per cent for the online gaming industry.

The Internet and Mobile Association of India (IAMAI) on Monday urged the GST Council to continue maintaining the GST on online gaming at 18 per cent and any further increase will hamper the overall wellbeing of the industry.

Discussions are ongoing among various stakeholders to increase the GST rate to 28 per cent for the online gaming industry.

There is no clarity on whether this will apply only to real money games or casual games as well, given that the former being a sub-segment of online gaming.

“Any such increase in the GST rate is likely to turn businesses in the sector unviable, leading to complete shutdown which, in turn, will result in loss of a large number of jobs,” the industry body said in a statement.

This will also result in “a loss of investor-confidence debilitating India’s online gaming industry, which is currently witnessing fast and exponential growth of 35 per cent CAGR,” the IAMAI added.

According to a recent report by BCG and Sequoia, the Indian online gaming industry is expected to reach $5 billion by 2025.

The industry body said that increasing the GST rate will lead to an erosion of tax-base on the one hand while encouraging the spawning of grey markets on the other.

“It is also essential to treat only the Gross Gaming Revenue (GGR) or Platform Fee as liable to GST at 18 per cent and to treat the ‘prize pool’ as the actionable claim as per Entry 6 of Schedule III of the CGST Act, 2017,” it added.

Multiple industry experts have opposed clubbing the online gaming industry in the 28 per cent GST bracket along with racing, gambling and betting.

Earlier this month, the Group of Ministers (GoM) on casinos, race courses and online gaming discussed various aspects, including the possible GST rates and technicalities.

GoM Convener and Meghalaya Chief Minister Conrad K. Sangma said the meeting also discussed whether there be a common or different GST rates on online gaming.

According to Sangma, the annual turnover of online gaming only is around Rs 30,000 crore and the annual growth is 25 to 30 per cent.

Few more technical aspects were needed to be discussed before the next meeting of the GoM this month.

Read all the , Breaking News and IPL 2022 Live Updates here.