GST on online gaming, casinos and horse racing soon, might be put in 28% slab

The Group of Ministers (GoM) met on Monday in New Delhi to talk about levying GST on online gaming, casino and horse racing. The GoM is open to considering all three games as different and is further looking at legal opinion on the applicable rate and valuation base that will be considered for levying GST on all three formats.

Meghalaya Chief Minister Conrad Sangma wrote on Twitter, “Chaired a meeting of the GoM on casinos, race courses & online gaming in New Delhi After taking the opinion of stakeholders & after successive meetings to seek the suggestions of all members, we will take legal opinion before submitting the final report. @nsitharaman.”

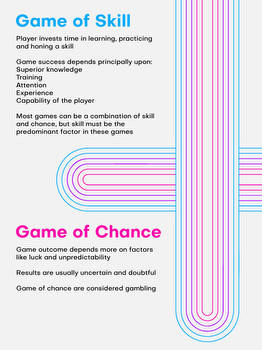

All India Gaming Federation (AIGF) CEO Roland Landers, while reacting to the development, said that as per the media reports, it seems the GoM has opined that all the three sectors - online gaming, horse racing and casinos are different in nature. “The GoM recognising the constitutional and legal differences and nuances of online games is very promising. As AIGF, we are very hopeful that the GoM will arrive at a progressive and constitutionally sound recommendation for rate and valuation for our industry,” he said.

The GoM has not yet reached a consensus and aims to finalise the report in the next few days. “The GoM had been indicating that the tax rate on all 3 (online gaming, casinos, and horse racing) might be taken to the highest category of 28% on which the entire gaming industry had made representations to consider taxability on online gaming @ 18% which is at par with global taxability,” said Ankur Gupta, Practice Leader (Indirect Tax), SW India.

With the advent of technology and the use of handheld devices, the online gaming market is fast growing at US$ 3 billion with more than 400 million users and is expected to grow rapidly in the next half a decade.

“Therefore, it is important to put taxability at par with global tax rates so that the Indian industry remains competitive. It is a welcome move that GoM is now open to considering levying different GST rates as this gives an opportunity to the gaming sector to re-approach the relevant stakeholders and make representation on keeping the GST rate @18% as online gaming requires skills and should not be made comparable to betting or game of chance,” he said.