Gaming & Gambling Update

Recent Developments:

Michigan Targets Bovada, Illegal Online Gambling

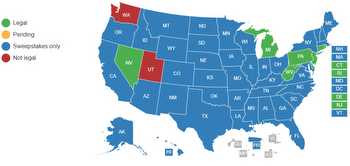

In a direct action against the illegal gambling market, the Michigan Gaming Control Board (MGCB) issued a cease-and-desist order to offshore operator Bovada. State regulators asserted that Bovada was in violation of several state laws governing gambling in Michigan. MGCB chief of staff Kurt Steinkamp emphasized that the organization is committed to enforcing gaming laws that create a legal market and suggested that other violators beyond Bovada were known to MGCB.

Bovada already ostensibly blocks participation in several states, including Nevada, New Jersey, New York, Maryland and Delaware. Regulators from other states, including Pennsylvania, California, Massachusetts and Arizona, have indicated they are aware of the recent action taken by MGCB.

New York Passes Bill on Downstate Casino Licensing

In its closing days of this year’s session, the New York state legislature passed Bill S.9673A, which requires that regulators receive applications for three new downstate casinos by August 31. The bill directs the Gaming Facility Location Board to issue its recommendations by December 31, 2025, and the New York State Gaming Commission to award licenses the following month. S.9673A has now been sent to New York Governor Kathy Hochul (D) for her signature.

The licensing process for the downstate casinos has moved slowly since the 2013 state constitutional amendment that authorized the casinos, after first permitting four now-operational upstate casinos. Bidders for the downstate sites reportedly include MGM Resorts International, Hard Rock, Wynn Resorts, Las Vegas Sands, and Caesars Entertainment.

Swedish Study Asserts Link Between Tax Rate and Problem Gambling

A recent study out of Sweden asserted a link between the tax rate on legal gambling and the prevalence of problem gambling. The Swedish Trade Association for Online Gambling (BOS) commissioned the study, done by Copenhagen Economics, in response to the country’s plan to raise its tax rate on online gambling from 18% to 22%. The study found that while annual tax revenue will likely increase, thousands of customers will respond to the tax hike by switching to unlicensed, unregulated gambling sites. Due to the lack of responsible gaming and consumer protection controls on unlicensed sites, the study estimates that an additional 591 to 1,247 people will develop problem gambling habits.

This study comes amid a period of increased scrutiny of both the tax rate on online gaming and the necessity of consumer protection measures. Gaming operators argue that overly high tax rates will make regulated offerings uncompetitive and drive increased patronage to unlawful sites.