Covid Fraudster Returned to Custody Following Discovery of Las Vegas Casino Activities

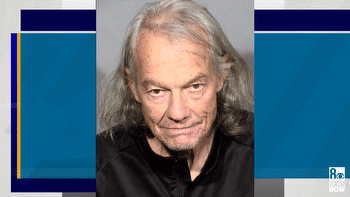

RALEIGH, N.C. – A Greenville man was returned to custody after violating the terms of release pending service of his prison sentence.

In May of 2021, Shawn Allen Farmer, 53, of Greenville, was sentenced to 15 months in prison for fraudulently obtaining Covid-19 disaster loans, and for engaging in bank fraud using stolen Social Security numbers. Although initially held in custody, Farmer was released to seek medical care before reporting to prison. While on release, Farmer was under the supervision of the United States Probation Office and was not permitted to travel.

In January of 2022, members of the Covid Fraud Benefits Task Force discovered that Farmer had travelled to Hawaii without permission and obtained a Hawaii driver’s license. Agents further learned that Farmer had cashed out as much as $92,000 at casinos in Las Vegas. Significantly, when identifying himself for tax purposes, Farmer utilized a Social Security number that did not belong to him. At the time of these events, Farmer still owed more than $42,000 on his federal criminal judgment.

Farmer was arrested following the discovery of these events. Last Friday in federal court, United States District Judge Terrence W. Boyle revoked Farmer’s release and directed that he be sent to prison to serve his sentence.

The defendant previously pled guilty to False, Fictitious, and Fraudulent Claims, in violation of Title 18, United States Code, Section 287; and Bank Fraud and Aiding and Abetting, in violation of Title 18, United States Code, Section 1344 and 2.

The Covid Fraud Benefits Task Force is a collection of law enforcement agencies assembled by the United States Attorney’s Office to investigate and prosecute individuals and companies that defrauded government programs providing financial relief in the midst of the Covid crisis.

Michael Easley, U.S. Attorney for the Eastern District of North Carolina made the announcement after the defendant’s release was revoked. The Internal Revenue Service Criminal Investigation investigated the case and Assistant U.S. Attorney William M. Gilmore served as the prosecutor.