Casino Giant's Biggest Investor Sells Massive Stake

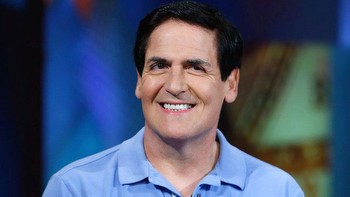

Las Vegas Sands Corp (NYSE:LVS) are 3% lower at $46.25 at last glance, after Miriam Adelson, the casino company's largest shareholder, sold $2 billion of stock. The investor said the proceeds will be used to "fund the purchase of a majority interest in a professional sports franchise" with The Wall Street Journal reporting Mark Cuban is selling a majority stake of the NBA's Dallas Mavericks to Adelson.

Coming into today, LVS is battling with its year-to-date breakeven mark, sitting 0.9% lower in 2023. The equity is looking to open around $45.50, or levels not seen since mid-October, while its short-term 20-day moving average reestablishes itself as resistance.

Options look like a good way to weigh in on LVS, too. The security sports a Schaeffer’s Volatility Index (SVI) of 28%, which ranks in the low 12th percentile of its annual range, meaning options traders are pricing in low volatility expectations at the moment.