Analyst Sees No Basis For ICasino Cannibalization Fears

Gaming industry analyst Matt Roob has heard plenty of concerns raised in recent years about how legalizing online casinos could cannibalize revenue from brick-and-mortar properties, but he’s yet to see the evidence of it occurring.

Instead, the senior vice president of financial analysis for the independent Spectrum Gaming Group has found plenty of numbers suggesting that iCasinos only add to overall gaming revenue rather than subtracting from existing options.

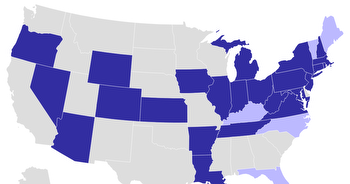

Referencing states where online slots and table games can legally be played, Roob said, “You look at the six states that have it, and their [physical] casino revenue before and their casino revenue now, and it’s all pretty much the same.”

Roob spoke to US Bets on the topic following his most recent analysis of it, focused on Pennsylvania land-based casino revenue.

Along with residents of New Jersey, Michigan, Connecticut, West Virginia, and Delaware, Pennsylvanians can play casino games on their phone or computer all day, any day, if they want. Pennsylvania also has 17 physical casinos, many of which have removed some of their slot machines in recent years, citing various reasons other than online competition.

Spectrum produces in-depth reports as a paid consultant to state governments and the casino industry, but it also recently released on its own a brief, two-page look at Pennsylvania’s online and brick-and-mortar casinos assessing “the ongoing question of whether iGaming cannibalizes casino revenue.”

While the analysis itself stated there was “no firm conclusion,” Roob focused on how physical casino revenue has remained steady while iCasino has continued growing — to $1.6 billion now on an annual basis. That pattern is similar to what has consistently been found among legalized iGaming states, he said.

“I have no idea if people are substituting a trip to the iPhone for a trip to the casino, but it has not hurt physical casino revenue,” Roob said.

A fear of the unknown?

Spectrum did a more comprehensive cannabalization examination in 2022 for the Indiana Gaming Commission. Indiana has been a state deemed one of those most likely to next legalize online casinos, but legislation thus far has failed to pass, with potential harm to the state’s physical casinos cited by lawmakers as a key concern.

Spectrum’s lengthy report, which looked in detail at experiences of the six existing iCasino states, found no basis for such fears. The online gambling, it stated, reaches new customers while creating new options that may attract older ones with “little, if any, cannibalization of revenue from established casinos.”

“Igaming and other forms of digital play will attract younger players, but the benefits of convenience will also increase participation from the gaming industry’s existing demographic base,” the market analysis found.

But as brick-and-mortar casino revenue in the iGaming states including Pennsylvania has basically been flat, the unknown is whether earnings would have grown without online casino play. In each state, there are many variables making it difficult to provide an answer. In Pennsylvania’s case, it’s difficult to isolate the impact of iGaming from the competition from gray-market skill games and from five new commercial casinos added in recent years.

“There’s just no way to know,” Roob said, in terms of what might have happened to the existing casinos in various states if not for new iGaming competition.

A brief summary Spectrum recently did of the New Jersey and Connecticut casino and iCasino industries concluded that New Jersey’s casinos had not been harmed by online play, while it stated Connecticut’s tribal casinos experienced a 1.5% decline in slots revenue after iGaming arrived. Various other factors could have impacted the small decline, the analysis said, including some smokers instead gambling at home once the casinos remained smoke-free following pandemic reopenings.

Spectrum’s Indiana report noted the casino industry itself once had loud opponents of online gaming, but those voices are heard no more. Many of the leading companies operating physical casinos are the same ones benefiting now from profits in their iGaming subsidiaries, on the sports betting side as well as from online casino play.

Roob said that while the cannibalization fear is still raised in states as they consider legalizing iCasinos, that may be more likely from unions looking to protect casino workers’ jobs or lawmakers who have casinos in their districts and share that concern about erosion of employment.

“It’s more a fear of the unknown,” he said. “I believe from the evidence we have looking at New Jersey, Pennsylvania, Michigan, Connecticut, and West Virginia, it doesn’t appear there is any cannibalization of physical casinos by iGaming.”