With Cosmopolitan sale nearing, Blackstone still has money on Vegas

Blackstone Group’s time as a Strip casino operator is drawing to a close, but that doesn’t mean the New York-based investment conglomerate is done with Las Vegas.

Through its Blackstone Real Estate Investment Trust (REIT), the company will continue to own the land and buildings associated with four Strip properties operated by MGM Resorts International.

On Wednesday, Blackstone prepared to say goodbye after eight years as the operator of The Cosmopolitan of Las Vegas, after selling the operations of the Cosmopolitan to MGM Resorts for $1.625 billion.

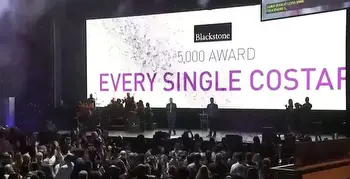

Blackstone executives held an employee appreciation event inside the Chelsea theater. At the conclusion, Cosmopolitan CEO Bill McBeath announced that all 5,400 employees would receive a bonus of $5,000 each – an outlay of $27 million by Blackstone.

“Our success was completely attributable to the people on the ground, the people cleaning the rooms, working the restaurants, working the front desk, dealing cards,” Tyler Henritze, head of strategic investments for Blackstone Real Estate Americas said following the raucous announcement. “I think this is just a very small way for us to show our appreciation.”

Through Blackstone’s REIT, the company will retain an 80 percent ownership in the Cosmopolitan’s 8.7-acre Strip parcel. Stonepeak Partners and Cherng Family Trust (founders of the Panda Restaurant Group that includes the Panda Express chain), are also part of the ownership group – a deal valued at $4.055 billion.

MGM Resorts will pay an annual rent of $200 million to operate the Cosmopolitan.

McBeath, who will remain with Blackstone but will no longer be the Cosmopolitan’s top executive, told employees during the event that MGM CEO Bill Hornbuckle understands the Cosmopolitan “has its own brand and culture” and has been successful over the last eight years.

“He stated the Cosmopolitan has to have its own identity,” McBeath said.

The Nevada Gaming Control Board recommended approval for MGM Resorts’ acquisition of the Cosmopolitan’s operations last week, and the Nevada Gaming Commission will consider the transaction during a hearing Thursday in Las Vegas.

Henritze said Blackstone “would buy a (Strip) asset to operate again if the right opportunity came up.”

For now, however, Blackstone is focused on a $6.3 billion purchase of Australian casino developer Crown Resorts, which will see Blackstone become the operator of the country’s largest gaming operator.

But Henritze said Blackstone continues to evaluate the Las Vegas market. UNITE HERE President D. Taylor, speaking during the employee appreciation ceremony, told Blackstone executives he had some “suggestions” about which Las Vegas casinos Blackstone should purchase, an apparent nod to the Culinary Union’s longstanding labor dispute with Station Casinos.

“Nothing would make myself and our team more excited than to be able to get the band back together,” Henritze said. “I remain very bullish and optimistic on Las Vegas and on gaming. We've had an incredible run with the Cosmopolitan here. If we had another opportunity to be back in Vegas operating an asset like this with people like this, we'd love that.”

Blackstone paid $1.73 billion for the Cosmopolitan in 2014, spending another $500 million on property upgrades, renovating the 3,000 hotel rooms and suites and adding new restaurants and bars. The Cosmopolitan opened in December 2010. The property was the last ground-up casino resort to open on the Strip for 11 years until Resorts World Las Vegas opened last June.

Henritze said after the Cosmopolitan purchase, Blackstone focused on becoming a landlord.

“In the last couple of years, the opportunities for our capital have been more on the real estate side of things,” he said.

In 2019, the Blackstone REIT acquired 95 percent of Bellagio from MGM Resorts with the casino operator retaining 5 percent of a joint venture valued at $4.25 billion. MGM pays the joint venture $245 million in annual rent for Bellagio.

In 2020, Blackstone and real estate investment trust MGM Growth Properties bought MGM Grand Las Vegas and Mandalay Bay for $4.6 billion. Blackstone holds 49.9 percent of the partnership and MGM Resorts pays annual rent of $292 million to the joint venture.

A few weeks ago, VICI Properties took over MGM Growth’s 50.1 percent stake in the joint venture when it closed its $17.2 billion purchase of the rival REIT.