WHY ONLINE CASINOS ARE TAKING KYC AND AML SERIOUSLY, NOW MORE THAN EVER

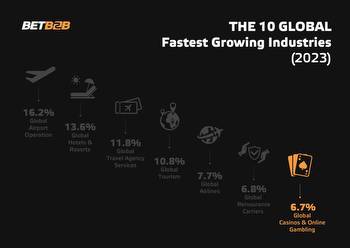

Experts predict that the global online gambling industry will become worth $94.4 billion in the next two years.

Online casinos process transactions worth millions of dollars, making them just as important as banks or financial institutions. Online casinos need to comply with stricter regulations and implement serious measures to prevent unscrupulous individuals from using them for identity theft, money laundering, and other financial crimes.

Online casinos are fast gaining popularity. The Covid-19 pandemic is one of the major factors responsible for the growth of the global casino gaming industry. As online casinos gain popularity, gambling regulations become more stringent.

The stringency of online casino gaming regulations forces operators to expand their compliance teams. Operators have to invest more in anti-money laundering measures and identity verification procedures. They have to use third-party AML and KYC solutions to deal with backlogs and reduce the time required for verification procedures.

Online casinos have to chuck manual KYC procedures because they are time-consuming and outdated. Moreover, they are prone to errors and are expensive.

Reputable casinos have KYC protocols in place to verify players’ identities and flag up potential money laundering practices, from dodgy-looking accounts. When choosing the right casino to play at, these might not be your initial deciding factors, but they certainly should be on your priority list, and we’ll elaborate further in this article. Firstly, an operator that’s KYC-regulated automatically implies it follows compliance in accordance gambling regulatory laws, which have recently become even more stringent, particularly in the UK. Of course, this should be reassuring to players because a complaint casino means a licenced and regulated casino.

Legal Obligations of Online Casinos

Gambling regulations worldwide require online gambling sites to verify their customers’ age, identity, source of funds, and location. The purpose is to prevent fraud, protect players, and ensure that winnings reach the right person.

Before collecting information and identification documents from their players, online casinos have to gain their trust by providing a secure and fair gaming environment that prioritizes customer satisfaction. They should convince customers that they will handle player data appropriately and protect player privacy.

Operators seeking to prioritize compliance need advanced third-party identity verification solutions for the following reasons:

- Keep money launderers, tricksters, and criminals away from their gaming platforms.

- Comply continuously with ever-changing gambling regulations worldwide.

- Deliver a trustworthy, user-friendly, and seamless online casino gaming experience.

Why Online Casinos Take AML and KYC Seriously

Here are a few reasons online casinos are taking AML and KYC seriously more than ever:

- According to the latest studies, money laundering is a concern for online casinos. Gambling operators in Finland had submitted 9000+ money laundering reports in 2014.

- Studies also reveal that groups of criminals collaborate to launder money at online casinos. The Corozzo Network, which operated from 2005 to 2008, had four illegal online casinos, through which they laundered over $10 million.

- Cantor Gaming had to pay a fine of $22.5 million to many regulatory bodies for its failure to implement anti-money laundering measures. The company could do nothing when a gang called Jersey Boys used its platform to launder huge amounts of cash.

Moreover, technological advancements make it easier for money launderers and help them devise complex money laundering schemes. Money laundering is easier than ever and hard to detect because of the introduction of payment methods like electronic wallets, prepaid cards, mobile payment methods, and virtual credit cards.

Online casinos are taking AML and KYC procedures more seriously than ever because they are the only way to avoid becoming vehicles of criminals and money launderers.

To Conclude

Online casinos are now looking for third-party AML and KYC solutions that help them comply effectively without investing a lot of money. Third-party digital KYC solutions can conduct exhaustive background checks on every player signing up at the online casino. They can identify threats in time and enable operators to take immediate action.

Accurate digital identity verification makes online casinos trustworthy, expands their player base, and increases revenue. The financial sector uses digital KYC services to stay free from money laundering and financial crime. And online casinos are increasingly using them to create secure gaming platforms for their players.