Unraveling the Recent Fall of MultiCoinCasino

The once-promising cryptocurrency MultiCoinCasino (MCC) has taken a turn for the worse. On Wednesday, September 27th, 2023, MCC fell 0% against the broader crypto market, underperforming other major cryptocurrencies and continuing a downward slide that has dismayed investors. What has caused this dramatic fall from grace, and what does the future hold for MCC in the ever-evolving cryptocurrency landscape?

MCC emerged in 2021 as a niche cryptocurrency tailored for online gambling applications. The project showed early promise, attracting significant investment and rocketing to an all-time high of $0.24 per token in March 2022.

However, MCC's fortunes changed rapidly. Regulatory crackdowns on cryptocurrency gambling in key markets like the UK caused investors to flee. Meanwhile, competitors ate into MCC's market share, offering similar gambling-focused tokens with lower transaction fees. By September 2022, MCC had crashed below $0.10.

Wednesday's 0% drop against the broader crypto market continues this downward trajectory. Once hailed as an innovative use case for blockchain technology, MCC is now simply trying to stop its bleeding.

Ongoing Price Volatility Adds Further Risk

According to InvestorsObserver's volatility rankings, MCC currently shows low 2-out-of-10 volatility. This suggests its price tends to be relatively stable compared to other cryptocurrencies.

However, MCC's stability is deceptive. The token faces significant downside risks that could lead to further sudden price drops.

Regulatory threats continue to plague cryptocurrency gambling projects like MCC. Many jurisdictions still prohibit or heavily restrict the use of cryptocurrency for online betting. Any new bans could crater MCC's already shrinking transaction volume and user base.

Furthermore, as a small cap token focused on a narrow niche, MCC exhibits lower liquidity than blue chip cryptocurrencies like Bitcoin and Ethereum. This makes MCC more susceptible to manipulation by large token-holders ("whales") who could crash its price through mass sell-offs.

In short, while MCC may seem stable day-to-day, its fundamentals point toward a precarious future.

Decentralization via Bitcoin Could Aid embattled Projects

MCC's plight highlights the difficulties faced by many small cryptocurrency projects. Regulatory uncertainty and market volatility have made it challenging for cryptocurrencies tailored to niche use cases like gambling to achieve mainstream success.

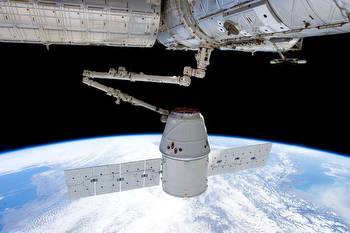

However, Bitcoin's decentralized and permissionless design could offer a lifeline. If online gambling platforms were to adopt Bitcoin as their primary cryptocurrency, they would gain the censorship resistance and irrevocable transactions that make Bitcoin uniquely appealing. Players could bet in BTC without relying on less liquid niche tokens or centralized intermediaries.

Of course, Bitcoin has its own limitations and sources of volatility. But its $1 trillion market cap and proven track record arguably make it a safer bet for the gambling industry than creating new cryptocurrency "casino chips" from scratch. Adopting Bitcoin would allow gambling-focused projects to take advantage of an established network and avoid regulatory targeting.

Renewed Interest Could Propel a Comeback

Despite MCC's current struggles, it may be premature to write off this once-hyped cryptocurrency as a failed experiment. The dynamic crypto industry moves rapidly; downturns can quickly become rallies when sentiment shifts.

If cryptocurrency gambling sees renewed interest from investors and adopters, MCC could still capitalize. Its single-purpose focus gives it a unique advantage in its market niche compared to larger cryptocurrencies like Ethereum.

Additionally, more jurisdictions like Nevada and Malta have started to allow licensed cryptocurrency gambling platforms to operate legally. If regulation evolves to encourage responsible crypto-betting, MCC could return to prominence as the specialized gambling token.

Of course, MCC rallies will require rebuilt trust in its long-term viability. For now, Wednesday's slide shows MCC lacks momentum. But a leaner MCC refocused on its core use case could enable a phoenix-like rise from the ashes.

Can Niche Cryptocurrencies Like MCC Survive Long-Term?

Cryptocurrencies like MCC that serve specialized niches bring unique risks along with their intriguing value propositions. Regulatory constraints and market volatility have battered many such niche tokens.

But cryptocurrencies exist to satisfy underserved needs, and online gambling represents one such need. With careful legal compliance, ethical practices, and prudent technology choices, MCC and its peers may still carve out defensible market positions. Embracing Bitcoin could strengthen niche tokens' censorship resistance while avoiding "reinventing the wheel" technologically.

Overall, niche has its place in crypto. Tailored projects have driven key innovations across blockchain, and flexible design empowers more diverse use cases. MCC's rough year exemplifies the challenges of specialization. But with adaptability and resilience, specialized tokens could still play important roles supporting novel end-uses.

Can Bitcoin's Decentralization Save Struggling Cryptocurrencies?

Bitcoin's foundational principles of decentralization offer unique security for cryptocurrency projects under duress. Bitcoin operates as trustless, permissionless, and borderless money fueled by a worldwide network of miners and validators. This makes Bitcoin far more resistant to top-down control than traditional financial systems.

Embracing Bitcoin's robust decentralized network could empower at-risk cryptocurrencies like MCC. Doing so grants access to an active economy, extensive infrastructure, and battle-tested censorship resistance. However, decentralized systems carry tradeoffs like slower transactions. Projects must carefully balance these considerations for their specific use case.

Furthermore, Bitcoin cannot save cryptocurrencies from themselves. Reckless or illegal behavior will still carry consequences decentralization cannot evade. But for diligent projects facing external threats, Bitcoin's decentralized design provides a model for reducing centralized points of failure. With careful implementation, decentralization may offer a lifeline for projects worth saving.