ProShare Advisors LLC Has $2.92 Million Position in Las Vegas Sands Corp. (NYSE:LVS)

ProShare Advisors LLC lessened its holdings in Las Vegas Sands Corp. (NYSE:LVS) by 2.3% in the 1st quarter. The institutional investor owned 74,932 shares of the casino operator’s stock after selling 1,803 shares during the period. ProShare Advisor's holdings were worth $2.915 million at the end of last quarter, up from $1.9 million a quarter earlier. Capital World Investors raised its position in Vegas Sates by 74.1% during last 4th quarter and now owns 34,255,198 shares. Barrow Hanley Mewhinney & Strauss LLC raised their position by 15.8% and owns 8,835,528 shares now. Invesco Ltd. raised it's position with Las Las Sands by two.7% since the fourth quarter to $327,530,000. Geode Capital Management LLC has increased its stake in LVS by 141,127 shares in last 3 months.

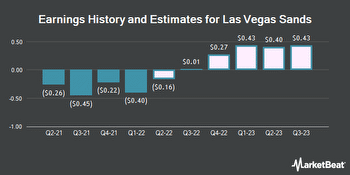

Las Vegas Sands Corp. (NYSE:LVS) last announced its quarterly earnings data on Wednesday, July 20th. The casino operator reported ($0.34) earnings per share for the quarter, missing the consensus estimate of ($.29) by ($ 0.05). Las Vegas Sates had a net margin of 45.39% and a negative return on equity of 31.93%. The business had revenue of $1.5 billion during the same quarter last year.

ProShare Advisors LLC has a $2.92 million position in Las Vegas Sands Corp. (NYSE:LVS). LVS has been upgraded by several analysts. Two analysts have rated the stock with a sell rating, three have assigned a hold rating and eight have issued a buy rating to the company. L VS has consensus rating of “Moderate Buy” and a consensus price target of $48.38.

Las Vegas Sands Corp. develops, owns and operates integrated resorts in Asia and the United States. It owns The Venetian Macao Resort Hotel, The Parisian Hotel Macau, Plaza Macaus, Four Seasons Hotel and Marina Bay Sands in Singapore.