Las Vegas Hospitality Workers Authorize Strike As Investor Interest In Casinos Grows

Las Vegas hotel and casino workers are in negotiations for a new five-year contract.

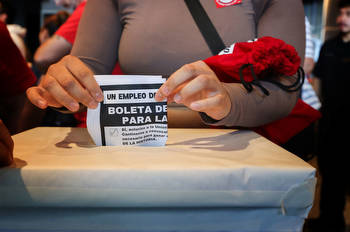

Las Vegas hospitality workers voted this week to authorize a strike in pursuit of a new five-year contract.

The workers are members of the Culinary Workers Union Local 226 and Bartenders Union Local 165, who are employed in nongaming positions at casinos on the Las Vegas Strip and the city’s downtown, Seeking Alpha reported. The contracts for about 40,000 workers at 22 resorts owned by MGM Resorts, Caesars Entertainment and Wynn Resorts expired Sept. 15, according to SA.

The strike authorization, which was approved by 95% of union members, is “largely symbolic but gives the labor leadership — who said they are negotiating with management in good faith — the ability to call for a walkout,” according to The Nevada Independent.

There is no date set for a walkout yet. However, if a walkout were to occur, it would leave the service and hospitality industries with a shortage of workers that could impact business.

The strikes are another in a string of labor actions that have taken place so far this year, and they come as casino real estate is growing more attractive to REITs.

In August, Blackstone agreed to sell its 22% stake in the Bellagio for $300M to Realty Income. Blackstone similarly sold its stake in the MGM Grand for $700M in late 2022.

These deals extend beyond Las Vegas. Last month, Gaming and Leisure Properties paid $100M for the land associated with the Hard Rock Casino development project in Rockford, Illinois. VICI Properties paid Foundation Gaming Group approximately $293M last December for two Mississippi properties, the Fitz Casino & Hotel in Tunica and the WaterView Casino & Hotel in Vicksburg, Mergers & Acquisitions reported.

Casino leases are typically structured as triple-net leases, John Orem, managing director and head of gaming and leisure investment banking at Stifel, told M&A.

“Gaming leases also typically include periodic escalators based on inflation, thereby offering a highly predictable, inflation-hedged source of income for investors,” Orem said.