Govt must step up oversight against online gambling

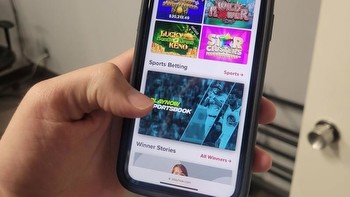

MOBILE financial services that have helped people by a great extent to recharge mobile balance, make payment, pay bills and transfer money without having to move out of the comfort of home and round the clock have worryingly come to be used as a means of digital gambling primarily because of oversight failures by both the financial authorities and the companies that run the services. Law enforcement agencies say that gambling on digital platform has become rampant and the platforms use mobile financial services as easy ways to do the illicit transactions. An executive director of the central bank says that it has become difficult to tackle online gambling transaction as both personal and merchant accounts of mobile financial services are used for transactions. The Criminal Investigation Department says that it arrested several dozen agents of the top two mobile financial services for their involvement in gambling transactions, noting that thousands of college and university students are involved in gambling. While this constitutes a moral infraction and keeps the students off their primary goal of studies, online gambling is also used to facilitate illicit capital flow. The Criminal Investigation Department, which is investigating 15 cases of online gambling, says that it has arrested more than 100 people in this connection.

The law enforcement unit says that most of the people arrested are agents of both mobile financial services and gambling platforms. The law enforcers say that a group of mobile financial services agents that they arrested had a daily transaction of about Tk 5 million from gambling, expressing fears that there are several thousand such agents involved in online gambling. The law enforcers say that they have earlier identified 5,000 mobile financial services agents involved in illegal transaction such as hundi and online gambling. An officer says that that it is difficult to establish the amount of money that is laundered abroad every year from online gambling platform, but the amount could not be several thousand crores of takas. He says that mobile financial services operators retain a certain percentage of the amount as commission but the most of the amount is siphoned off to countries such as China, India, Russia and Vietnam. The law enforcers say that local agents create an intermediary layer between the participants taking part in gambling and the global operators to facilitate monetary transaction. The police fear that online gambling might increase during the forthcoming cricket World Cup as several hundred digital platforms are actively targeting Bangladeshis, naming eight of such platforms that change names and domains which makes it difficult to bring them under surveillance.

While the central bank, which monitors transactions, says that it ends the agentship of 150–200 entities almost every day, mobile financial service operators report suspicious transactions to the central bank, the law enforcers remain alert and the Telecommunication Regulatory Authority blocks access to gambling web sites, smartphone apps and Facebook pages, the menace still continues. It is, therefore, imperative that all relevant agencies and authorities should step up their oversight to end online gambling to stop illicit capital flow.