DekaBank Deutsche Girozentrale Raises Holdings in Las Vegas Sands Corp. (NYSE:LVS)

DekaBank Deutsche Girozentrale lifted its stake in Las Vegas Sands Corp. (NYSE:LVS – Get Rating) by 22.0% during the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 593,711 shares of the casino operator’s stock after buying an additional 106,993 shares during the quarter. DekaBank Deutsche Girozentrale owned approximately 0.08% of Las Vegas Sands worth $21,896,000 as of its most recent SEC filing.

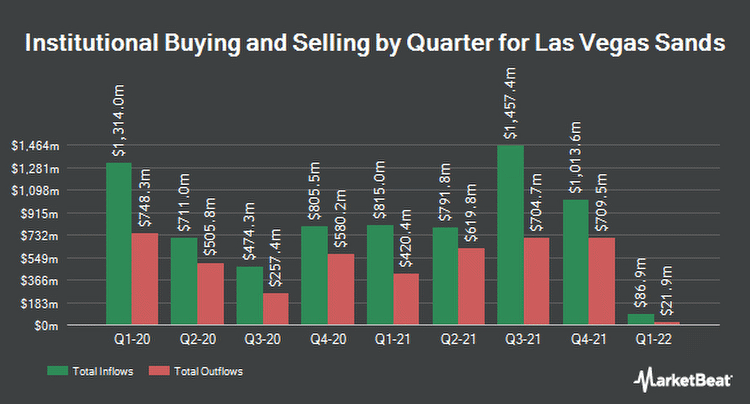

Several other institutional investors and hedge funds also recently modified their holdings of the company. Oppenheimer & Co. Inc. boosted its position in Las Vegas Sands by 35.1% during the fourth quarter. Oppenheimer & Co. Inc. now owns 8,419 shares of the casino operator’s stock worth $317,000 after purchasing an additional 2,187 shares in the last quarter. Oregon Public Employees Retirement Fund boosted its position in Las Vegas Sands by 2.2% during the fourth quarter. Oregon Public Employees Retirement Fund now owns 27,957 shares of the casino operator’s stock worth $1,052,000 after purchasing an additional 600 shares in the last quarter. Quadrant Capital Group LLC boosted its position in Las Vegas Sands by 223.9% during the fourth quarter. Quadrant Capital Group LLC now owns 1,694 shares of the casino operator’s stock worth $64,000 after purchasing an additional 1,171 shares in the last quarter. Assenagon Asset Management S.A. purchased a new position in Las Vegas Sands during the fourth quarter worth approximately $228,000. Finally, Nomura Asset Management Co. Ltd. boosted its position in Las Vegas Sands by 10.0% during the fourth quarter. Nomura Asset Management Co. Ltd. now owns 76,878 shares of the casino operator’s stock worth $2,894,000 after purchasing an additional 6,990 shares in the last quarter. Hedge funds and other institutional investors own 34.33% of the company’s stock.

A number of equities analysts have commented on LVS shares. Stifel Nicolaus increased their target price on Las Vegas Sands from $51.00 to $56.00 and gave the company a “buy” rating in a report on Thursday, January 27th. Wells Fargo & Company increased their target price on Las Vegas Sands from $41.00 to $45.00 and gave the company an “equal weight” rating in a report on Thursday, January 27th. StockNews.com started coverage on Las Vegas Sands in a report on Thursday, March 31st. They set a “sell” rating for the company. Morgan Stanley increased their target price on Las Vegas Sands from $42.00 to $44.00 and gave the company an “equal weight” rating in a report on Tuesday, January 18th. Finally, UBS Group raised Las Vegas Sands from a “neutral” rating to a “buy” rating and set a $53.00 target price for the company in a report on Wednesday, January 19th. Two analysts have rated the stock with a sell rating, six have issued a hold rating, five have given a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, Las Vegas Sands currently has a consensus rating of “Hold” and a consensus target price of $51.23.

Las Vegas Sands stock traded down $0.16 during mid-day trading on Friday, hitting $35.95. The company’s stock had a trading volume of 3,919,247 shares, compared to its average volume of 7,170,534. The firm has a market capitalization of $27.47 billion, a PE ratio of -28.53 and a beta of 1.31. Las Vegas Sands Corp. has a 1 year low of $31.26 and a 1 year high of $62.85. The company has a current ratio of 2.15, a quick ratio of 2.14 and a debt-to-equity ratio of 6.55. The stock’s fifty day moving average is $41.23 and its two-hundred day moving average is $39.79.Las Vegas Sands (NYSE:LVS – Get Rating) last issued its quarterly earnings data on Wednesday, January 26th. The casino operator reported ($0.22) earnings per share for the quarter, topping the consensus estimate of ($0.23) by $0.01. The company had revenue of $1.01 billion during the quarter, compared to analyst estimates of $1.10 billion. Las Vegas Sands had a negative return on equity of 33.44% and a negative net margin of 22.70%. The firm’s revenue for the quarter was down .7% compared to the same quarter last year. During the same period in the prior year, the business posted ($0.37) earnings per share. On average, equities analysts expect that Las Vegas Sands Corp. will post 0.16 EPS for the current fiscal year.

Las Vegas Sands Profile (Get Rating)

Las Vegas Sands Corp., together with its subsidiaries, develops, owns, and operates integrated resorts in Asia and the United States. It owns and operates The Venetian Macao Resort Hotel, the Londoner Macao, The Parisian Macao, The Plaza Macao and Four Seasons Hotel Macao, Cotai Strip, and the Sands Macao in Macao, the People's Republic of China; and Marina Bay Sands in Singapore.