Cherokee announces record casino profits, plans for expansion

In the space of two days last week, the Eastern Band of Cherokee Indians announced its biggest per capita distribution and approved a loan agreement for a $275 million expansion to the Valley River casino in Murphy.

On Dec. 1, tribal members will receive checks worth $8,840 — or $7,514 after taxes — from casino profits earned from April 1 through Sept. 30. Unsurprisingly, the number dwarfs the pre-tax distribution of $4,889 from the pandemic-struck period that formed last December’s checks, but it also clocks in 22.5% higher than the $7,214 sent out in December 2019 — at the time, a record-high number.

This is due both to higher revenues and decreases in operational expenses required earlier in the pandemic, said EBCI Secretary of Finance Cory Blankenship. In 2020, the casinos closed completely from March 18 to May 12 — the first closure in the tribe’s 23-year gaming history — reopening initially with strict capacity, social distancing, masking and cleaning regimens in place.

“Both casinos performed very well throughout the fiscal year, which ended on September 30,” said casino spokesperson Brian Saunooke. “When compared to the prior year period, the resort in Cherokee was responsible for 65% of the increased distribution to the tribe.”

The casino enterprise is owned by the EBCI. Half the profits go to tribal operations, with the other half divided evenly between tribal members. Checks are distributed in June and December.

The 2021 fiscal year that ended on Sept. 30 saw tribal distributions 45% higher than 2020 and 17% higher than 2019, Saunooke said. The increased per capita distributions come despite a 0.79% increase in the number of tribal members receiving them since last year. In December 2020, the distribution had 16,014 certified shares, growing to 16,140.8 for next month’s distribution, Blankenship said. In December 2018, distributions were divided among 15,708.5 shares.

Because the December distribution is based on profits earned from April 1 through Sept. 30, the increased doesn’t reflect early success from the new Cherokee Convention Center , which opened Oct. 1. In its first month, the convention center hosted 28 groups, and the attached 725-room hotel tower kept 97% occupancy, Saunooke said. However, the casino is still struggling to hire workers, with about 500 positions now open. Non-tipped roles start at $15 per hour, with Harrah’s offering hiring bonuses up to $3,000.

Plans for Valley River

The distribution announcement was certainly good news for the tribe and its members, but Cherokee’s casino enterprise isn’t resting on its laurels. Just half a year after the $330 million expansion in Cherokee — bringing the resort up to 2.56 million indoor square feet — the Tribal Casino Gaming Enterprise hopes to break ground on a $275 million expansion to the Valley River Casino and Hotel in Murphy.

“You’ve got to keep your facility state-of-the-art to stay competitive in these markets,” loan facilitator Gina Jacobs told Tribal Council when presenting the amended and restated loan agreement Nov. 4. “I commend you for what the TCGE board has done and what the tribe has done to continue to update these facilities, expand these facilities.”

Tribal Council approved a master plan for the expansion during its July 8 meeting. On Nov. 4 , it approved the loan agreement necessary to allow the TCGE to borrow money and start construction, though three members — Vice Chairman Albert Rose, along with Wolfetown Representatives Bill Taylor and Bo Crowe — voted against it.

Saunooke declined to give a projected opening date for the expansion, but TCGE Chairman Tommy Lambert told Tribal Council that he hopes to break ground in February or March, with the loan expected to close Dec. 1.

Also unclear is what exactly the new construction will include. In July, Saunooke told The Smoky Mountain News that key features would include a new hotel tower, restaurant, hotel lobby café, spa and indoor pool, additional gaming space and more parking. Following the loan agreement’s passage, Saunooke said it was still too early to release specifics, such as the number of square feet, hotel rooms, gaming machines and parking spaces included in the expansion.

The amended and restated loan agreement appeared on the published agenda as a new ordinance, scheduled to be read and tabled for a vote the following month. However, Tribal Council approved the TCGE’s request to instead hear the legislation as a resolution — which is not subject to the 25-day tabling period — and hear it at the end of the agenda. The same three Council members who voted against the resolution also voted against the request. English Clerk Michelle Thompson and Indian Clerk Myrtle Driver Johnson read the entire resolution into the record, a task that took 53 minutes.

The long read came after a motion to hold the discussion off-air failed by the narrowest of margins. Painttown Representative Dike Sneed asked Tribal Council to cut the broadcast but allow those present to remain in the chambers, so that competing tribes like the Catawba Indian Nation wouldn’t have access to the discussion. However, Big Cove Representative Teresa McCoy pushed back, saying that the resolution document was already available online and that the community has the right to hear their representatives discuss the issue.

Though only five of the 12 members voted to broadcast the discussion, the weighted voting system brought it to a 50-50 split, leaving Sneed’s resolution dead on the floor.

Then, after the reading finished and Jacobs’ presentation started, Crowe interrupted to ask that the discussion be tabled for a work session.

“We do have some new Tribal Council members , and this is a ton of information. I mean a ton,” agreed Rose. “I know you guys are ready to get started too. I hate to rush into stuff because of the last couple times we have.”

Rose also questioned the accuracy of the $275 million ask, pointing out that the $330 million casino expansion was originally approved as a $250 million project.

Jacobs acknowledged that because of the pandemic, construction is “just a different world,” with costs going up for all manner of materials. However, she said, those escalations are built into the $275 million budget, which is based on preliminary calculations from the architecture firm, JCJ Architecture.

“It won’t be more than $275 (million),” Lambert promised. “We’ll do whatever we need to do to make sure it comes in under $275 (million).”

Chairman Richard French directed Jacobs to continue with her presentation.

The loan terms

The document restates existing loan terms for the TCGE’s $526 million revolving line of credit and the $330 million delayed term loan the TCGE already holds, adding $275 million for the Valley River expansion under terms similar to those agreed upon for the Cherokee expansion.

The $275 million delayed draw construction loan will allow the TCGE to begin drawing funds as needed during construction. Once the expansion is complete the debt will be converted to a term loan, with $6.875 million in principal payments due each quarter. The tribe will soon start to pay down its debt for the recently completed expansion in Cherokee, with $10 million in principal due each quarter. The loans include a variable interest rate that is currently at 1.84%, Jacobs said.

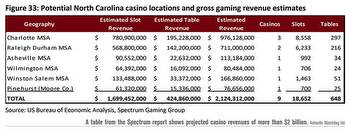

The agreement also contains provisions under which the principal payments could increase. If the Catawba Indian Nation or a location in Georgia within 200 miles of the Cherokee casinos opens a casino with at least 30 Class III gaming tables and 1,500 Class III slots — and the leverage ratio is more than 2 to 1 — quarterly principal payments would increase to $9.375 million for the Valley River expansion and $11.25 million for the Cherokee expansion.

According to Jacobs, it’s extremely unlikely those terms would kick in. Even if a competing casino comes online in that geographic area, she said, “we don’t believe we’ll ever get out of the 2 to 1 leverage ratio.”

The expansion is unlikely to be the TCGE’s last. The agreement includes an option to increase the borrowing amount by up to $500 million with Tribal Council approval but without closing on a separate loan document. That would ultimately save the tribe money, Jacobs said, bypassing the fees associated with resyndicating a loan.

“Hopefully we’ll continue to expand and grow these properties,” said Jacobs.