Charity voices concerns after move to let gamblers use debit cards on slot machines

A charity which supports families affected by gambling-related suicide has expressed its concerns over a move to allow gamblers to use debit cards on slot machines.

It comes after the government announced it intends to let people use debit cards to gamble on slot machines, with a transaction limit of £100 per direct card payment.

There will be a cap on the amount an individual can deposit into a machine in one go and staff will also be made aware when someone has reached their limit.

Apple Pay will be allowed, but other contactless payments remain banned.

Gambling with Lives has today issued a statement criticising the move, stating 'anything that increases access' to slot machines cannot be seen as a positive.

But ministers argue the proposals will allow pubs and casinos to compete in an increasingly cashless society.

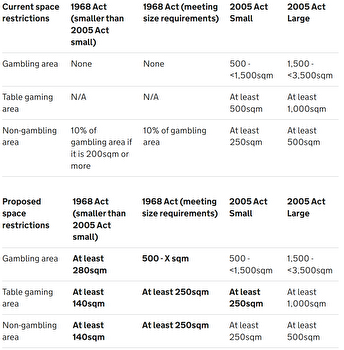

Liz Ritchie MBE, from the charity, told MailOnline: 'Slots venues are taking over our high streets and now they'll be allowed even more machines and be even easier to play with debit cards.

'Anything that increases access to highly addictive machines cannot be seen as a positive.

'We instead need to look at how we make these machines safer, by reducing deposit limits and slowing spin speeds.'

As it currently stands, a person can only use their debit card to gamble when making an indirect payment via a mobile app or by buying tickets to use for the machines.

Direct payments from debit cards are currently not allowed but this could change under the new legislation.

Players will have to wait 30 seconds after a card has been read and approved, before they can start depositing money onto the machine.

Any debit card payment would require authentication via chip, PIN or facial recognition for Apple Pay.

There will also be mandatory limits per session which will include a 'cooling-off period' when these limits are hit.

The new legislation will come into force automatically once the government regulator, Gambling Commission, has completed its consultation.