BIA: Radio To Book $164 Million In Online Gambling Ads In 2022.

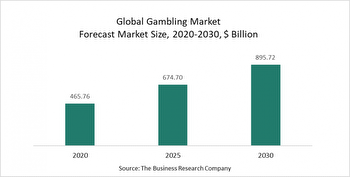

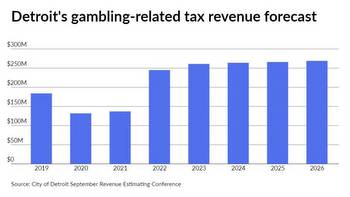

The fast-growing online gambling ad category is picking up steam. BIA Advisory Services, working with data from Nielsen Ad Intel Service, forecasts ad spending by local online gambling services will hit $1.8 billion this year. Over the air and digital radio will surpass $164 million as online gambling continues to grow into a major category, especially for companies that have sports stations in their portfolio, which offer a rich source of potential sports betting gamblers.

Both estimates are upward revisions to numbers BIA released in March when it forecast $1.6 billion will be spent by online gambling services on advertising in 2022, with $150 million going to local radio stations.

“With the potential of more states, such as California coming on board in the next couple of years, this new vertical is poised to deliver profitable advertising revenue opportunities,” BIA says in a sampling of data and insights from the just released BIA’s Online Gambling Forecast.

Over the air radio’s share of wallet in the lucrative category is currently around 8% and BIA estimates it will maintain this level through the end of its forecast in 2026.

With a 42.6% piece of the ad pie in 2022, over the air television easily controls the largest share of online gambling spending and BIA’s forecast calls for it to remain in the catbird position through 2026. That adds up to more than $748 million for local television stations in 2022. Adding to local TV’s dominance in the category are its digital assets, which will capture a 1.5% share of wallet.

More evidence of how online sports betting has ballooned into a major category came during second quarter earnings reports for radio’s publicly traded companies. At Beasley Media Group, for example, the vertical accounted for 5% of total revenue or $3.1 million. And with Massachusetts passing a bill to legalize sports betting, Beasley is optimistic that its Boston cluster, which includes “98.5 The Sports Hub” WBZ-FM, will soon be in line to book business from the lucrative category, possibly as early as football season.

Yet the second quarter of 2022 saw a slight downturn in the amount of online gambling spending as sportsbooks, including DraftKings and Caesar’s Entertainment, joined other categories in spending less on advertising and marketing in the quarter. After spending millions in advertising over the past few years as legalized sports wagering rolled out in many states across the country, sportsbooks tightened the reigns in the Q2 due to worries of a recession and another factor that is unique to the industry: “In order for sports bets to be placed, there needs to be sporting events to bet on, and there weren’t very many of those in Q2 2022,” said analyst Daniel Konstantinovic.

Additionally, after shelling out big bucks to capture market share in recent years, investors are urging some sportsbooks to now focus on profitability, which has led to a pullback in ad spending.

Spending is expected to pick back up in the second half of the year, which includes the NFL and college football seasons, and the upcoming 2022 World Cup, which will give Americans plenty of gambling fodder.

“Online gambling has become a strong advertising vertical at a time when local media channels are all looking to capitalize on opportunities to perhaps fill in where other categories have dropped off,” BIA says. “Timing couldn’t be better.”