After online gaming firms, GST authorities set sights on casinos

Tax authorities are closely looking into transactions of casinos to examine evasion of goods and services tax (GST) in the past. According to sources, more notices are likely to be sent to casinos in the coming days.

The move comes soon after the official notification to levy 28 per cent GST on online gaming, horse racing and casinos. In the case of casinos, consumers have to pay GST upfront on the full value of the chips that they purchase.

Casino chain DeltaCorp has already received two notices till date for GST. On October 14, it informed the stock exchanges that its subsidiary Deltatech Gaming had received notices for shortfall of tax amounting to Rs 6,384 crore.

“The amounts claimed in the abovementioned notice are inter alia based on the gross bet value of all games played during the relevant period. Demand of GST on gross bet value, rather than gross rake amount, has been an industry issue and various representations have already been made to the Government at an industry level in relation to this issue,” DeltaCorp had said.

Previously, on September 22, the company had received a notice for Rs 11,140 crore of unpaid GST dues. Additionally, three of its subsidiaries, including Casino Deltin Denzong, Highstreet Cruises, and Delta Pleasure Cruises, were served GST notice for Rs 5,682 crore.

Casinos in India are housed in the states of Goa and Sikkim, where they are also a popular tourist attraction. According to sources, tax officials are understood to be investigating any undue taxes from these casinos for previous years.

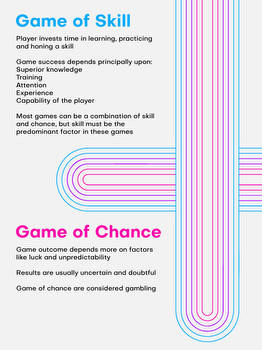

While a 28 per cent GST on online gaming, horse racing and casinos is effective from October 1 this year, the government has maintained that these activities attracted a 28 per cent GST in the past as well as they involve money and are in the nature of betting and gambling.

GST authorities are already investigating a large number of online gaming companies for alleged evasion of GST dues and have also sent notices to many of them. It is expected that more notices may be sent to these firms in the coming days.

Experts note that the issue will be put to rest based on the Supreme Court decision in the Gameskraft case. “The issue with respect to valuation will keep haunting the casinos till the Apex Court will decide the correct valuation of the actionable claim, especially with respect to the contribution related to participant to participant. The valuation done by including the complete contribution of the participants will lead to absurd and arbitrary tax demands,” said Abhishek A Rastogi, founder of Rastogi Chambers, who earlier argued for online gaming and casinos that no coercive action must be taken.